Where Are Beef Pork and Corn Prevalent in the Us

United States Agronomical Exports to Japan Remain Promising

Printer-Friendly PDF

There is an array of opportunities for U.S. agricultural exporters in Japan, though its unique culture and regulatory environment present challenges. While Japan has a failing population, it remains a wealthy country of nearly 127 1000000 people and is ranked as the 11th most populous state in the world. Japan is the globe's tertiary largest economic system, with a per capita gross domestic product (Gross domestic product)i of $41,200 in 2017. Demographic trends indicate that by 2021, 98 percent of the population will reside in urban areas where people are more likely to store at modern retail stores where imported consumer foods are sold. Nihon is the earth's 4th largest importer of agricultural goods and ran a $47 billion trade arrears with the globe in 2017, including a $12 billion agricultural merchandise arrears with the United States.2

Agricultural Situation and Consumption Trends

Japan'due south agricultural sector is relatively small-scale and slowly contracting. Co-ordinate to the CIA World Factbook, agronomics deemed for an estimated one per centum of Japan's GDP in 2017, and employed 2.9 percent of the Japanese labor force. The sector'due south efficiency is limited past the small and scattered nature of Japanese farmlands and high input costs, leaving the country dependent on imported agronomical goods and nutrient ingredients for a meaning percentage of its food consumption.

The Japanese market is highly competitive and consumers volition seek value and low cost, especially for majority bolt or ingredients. Consumers, however, may be willing to accept loftier prices for some retail products if they offer good quality or convenience. Traditional menus and tastes all the same generally guide the average Japanese consumer's consumption, but Western and other Asian ethnic cuisines are increasingly influencing the market place. Japanese consumers are generally wellness-conscious, with the food and beverage market continuing to focus on healthy and nutritious products. Anything perceived as providing benefits for wellness or convenience has a stronger appeal and greater hazard of becoming popular, including American healthy food trends. Although there is a tendency to adopt domestically produced nutrient products over imported food products, major retail chains in Japan are coping with demand for wellness foods by introducing imported goods under their own private labels, thus creating new opportunities for U.South. exporters.

Global Market Perspective

| Acme Japanese Agricultural Imports from the World | ||||||

| Product | Values in Billions USD | U.Due south. Market Share 2017 | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | ||

| Full Agricultural Imports | 57.six | 55.iv | 50.one | 48.9 | 51.9 | 25% |

| Pork & Pork Products | 4.8 | 5.3 | 4.3 | 4.9 | v.ii | 31% |

| Beefiness & Beefiness Products | 3.3 | 3.5 | 3.four | 3.5 | 4.0 | 48% |

| Poultry Meat & Products | 3.4 | 3.iv | 3.3 | iii.1 | 3.7 | 1% |

| Processed Vegetables | three.3 | three.two | 3.one | three.i | three.three | 16% |

| Corn | four.7 | 3.9 | three.two | 3.0 | 3.1 | 70% |

| Source: IHS Markit Data- BICO HS-6, Market share derived using U.S. consign data | ||||||

Nippon ranked as the fourth largest global agricultural importer in 2017, reaching $51.ix billion. Despite overall import declines between 2013 (57.6 billion) to 2016 (48.ix billion), U.S. exports values remained consistently to a higher place $11 billion. According to Japanese Ministry of Finance data, Nippon's top agricultural imports from the world are pork and pork products, beef and beef products, poultry meat and products, processed vegetables, and corn. The Us is the peak supplier of agricultural products to Nihon, with a 25 percent market share in 2017. The European union and Mainland china are the second and tertiary largest suppliers with 13 percent and 12 percent market shares, respectively, followed past Australia and Thailand with 8 percent market shares. U.S. marketplace share for key exports include pork and pork products (31 pct), beef and beefiness products (48 percent), and corn (70 per centum).

U.S. Exports to Nihon

| Peak U.Southward. Agronomical Exports to Nippon | ||||||

| Production | Values in Billions USD | U.Southward. Marketplace Share 2017 | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | ||

| Total Agronomical Exports | 12.2 | 13.1 | 11.one | 11.0 | eleven.9 | 25% |

| Corn | 1.eight | 2.vii | 2.0 | 2.1 | 2.two | 70% |

| Beefiness & Beef Products | 1.four | 1.vi | one.iii | 1.5 | 1.ix | 48% |

| Pork & Pork Products | 1.9 | 1.9 | 1.half dozen | 1.6 | 1.6 | 31% |

| Soybeans | ane.0 | i.0 | one.0 | 1.0 | 0.9 | 63% |

| Wheat | ane.0 | 0.9 | 0.7 | 0.half dozen | 0.seven | 48% |

| Processed Vegetables | 0.4 | 0.iv | 0.4 | 0.4 | 0.5 | xvi% |

| Hay | 0.five | 0.4 | 0.4 | 0.3 | 0.4 | 58% |

| Tree Nuts | 0.3 | 0.4 | 0.iv | 0.3 | 0.3 | 52% |

| Fresh Fruit | 0.3 | 0.three | 0.ii | 0.3 | 0.3 | fifteen% |

| Dairy Product | 0.3 | 0.4 | 0.ii | 0.2 | 0.2 | 15% |

| Source: USDA FAS Global Agricultural Trade Arrangement (GATS) – BICO-HS10 | ||||||

Japan is currently the fourth largest market for U.S. agricultural products, behind the NAFTA partners and China, with shipments totaling about $12 billion in 2017. The elevation U.S. agricultural exports to Japan for 2017 were corn ($2.2 billion), beef and beef products ($1.nine billion), pork and pork products ($one.vi billion), soybeans ($976 million), and wheat ($727 million). Although Japan remains a strong market place for U.S. exports, the Us risks losing market place share as Japan signs costless trade agreements with other agronomical exporting countries.

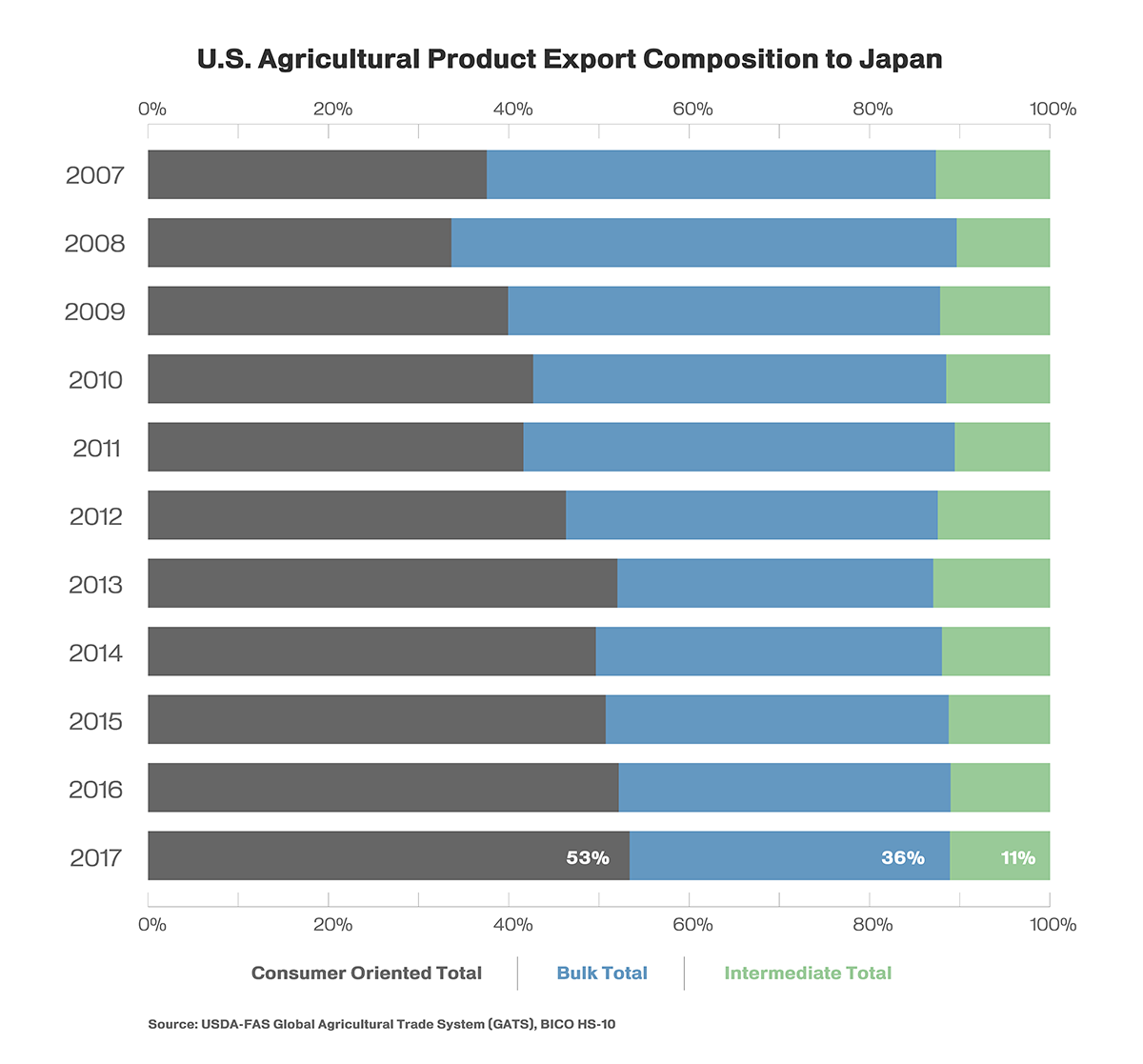

Consumer-Oriented Products: Nippon is the tiptop market place in Asia for U.S. consumer-oriented products. Since 2007, exports in this category have grown faster than whatever other U.Due south. export to Japan, every bit indicated in the graph in a higher place. In 2017, U.S. agricultural exports of consumer-oriented products to Japan totaled nearly $half dozen.4 billion (53 percent of U.Southward. agronomical exports to Japan in 2017). Bulk commodities business relationship for 36 percentage of U.S. agricultural exports to Japan, while intermediate products account for 11 percent. In improver, Japan is a worldwide leader in nutrient processing and manufacturing, with many industries relying on U.S. inputs.

Corn: Nihon is the second largest export market for U.S. corn in the earth. Given the absence of significant corn production in Japan, imports are projected to remain strong. In 2017, the United states of america exported most $two.2 billion of corn to Japan, approximately 24 percent of full U.Due south. corn exports to the world by value. The pinnacle U.S. competitor in the Japanese market is Brazil.

Beef and Beef Products: Japan is the largest export market for U.South. beef and beef products. In 2017, the The states shipped almost $1.nine billion of beef and beefiness products to Japan, accounting for 26 percent of all U.S. beef and beef products exports. The United states of america is Nippon's largest supplier of beef and beef products past value with a market share of 48 percent in 2017. The second largest exporter, Australia, has a 44 percent market share by value. Increasing consumer demand for beef volition continue to drive the market in 2018 due to a growing consumer preference for red meat.

Pork and Pork Products: In 2017, Japan ranked as the largest global importer of pork and pork products. Japanese pork imports from the earth grew 6 percent, from $iv.9 billion in 2016 to $v.2 billion in 2017. Japan's top imported pork products are frozen pork and fresh/chilled pork. For over a decade, the United States was the top pork supplier to Nippon. In 2017, however, the EU matched U.South. market share at 33 percent market share, followed by Canada (21 percent), and United mexican states (viii percent) and Republic of chile (ii percent). Nihon is highly protective of its pork manufacture and has excluded pork completely or included only provided minor tariff reductions and small tariff-rate quotas in previous bilateral merchandise agreements. All the same, the Japan-Eu agreement marks a change with Japan eliminating tariffs on more than sixty percent of its pork and pork product tariff lines inside 12 years. For more information, delight see IATR: Japan-EU Trade Understanding Threatens U.S. Pork Exports to Japan.

Soybean: In recent years, Japan has adopted program incentives to increment the domestic product of soybeans. Equally a result of these increased incentives, higher domestic product is expected to reduce the need for imported beans for food use. Yet, the need for soybeans for burdensome should remain strong. With a 63 percent market place share, the United States is the largest soybean supplier to Japan with exports totaling $976 one thousand thousand in 2017. Brazil, Japan's second largest soybean supplier, holds a 14 pct market share.

Wheat: Roughly 90 percent of the food wheat that Japan consumes is imported. The United states is the largest supplier of wheat to Japan, enjoying a marketplace share of 48 percent. Top U.S. competitors in the Japanese market are Canada (xxx percent marketplace share) and Australia (17 percent market place share).

Bio-Ethanol: Following a 2 year-long assay of U.S. ethanol'southward carbon intensity, in 2018 Japan adopted a standard that opens the door to 366 million liters (nearly 100 million gallons) of U.S. corn-based bio-ethanol (estimated value $170 1000000 per year). Nihon requires 824 meg liters of ethanol annually to be blended as a fuel oxygenate in its gasoline supply. Until this revision, Brazilian sugarcane-based ethanol had been the only source of ethanol that met Japan's requirements for low carbon fuel.

Policy Landscape

Despite being a primary net importer of agricultural products, Japan maintains high tariffs, restrictive and circuitous safeguards, and technical barriers to trade. Additionally, the The states volition face challenges in the Japanese market as U.S. competitors are gaining preferential access for several fundamental bolt. Japan and Australia take a trade bargain which lowers tariffs on imports of cardinal products from Commonwealth of australia, while Japan and the Eu have concluded a free merchandise agreement which will take effect in 2019. Additionally, the Comprehensive and Progressive Understanding for Trans Pacific Partnership (CPTPP) threatens to cut into U.Due south. market share and depress profits for U.Southward. agricultural exporters by granting preferential admission to Canada, Mexico, New Zealand and other international competitors. Canada is expected to gain preferential access to Japanese wheat and pork markets, while New Zealand will receive improved dairy access to Japan through partial tariff reductions and duty-free quotas. Mexico is too expected to enjoy tariff eliminations on fresh fruit to the Japanese market. Despite the increased competition Japan remains dependent on imports and has a historical preference for many U.S. products due to high quality, timely deliveries, and make recognition. U.S. suppliers may accept to work harder, but Nippon is expected to remain a top v U.S. market place destination for many years to come.

iUSDA, Economical Inquiry Service (ERS) defines purchasing power parity as a concept in which a given amount of U.South. dollars volition buy the same bundle of goods in all economies. In computing purchasing ability parity, adjustments are fabricated to commutation rates to raise or lower the relative value of currencies to equilibrate purchasing power.

iiJapan Ministry of Finance merchandise data

marchantallis1956.blogspot.com

Source: https://www.fas.usda.gov/data/united-states-agricultural-exports-japan-remain-promising

0 Response to "Where Are Beef Pork and Corn Prevalent in the Us"

Post a Comment